Presentation at User Meeting Hydro Scheduling 2019

Project background

The European power system is expected to become more integrated

and include a larger share of intermittent renewable production. This

development is driven by EU environmental targets and ambitions. In

Norway, new cables to Europe, tighter market coupling and increased

contributions from intermittent production is expected to give increased price volatility, larger volumes and higher prices in balancing markets. This will increase the importance and profit potential of a consistent view on trade in all short-term markets. The producers' ability to optimally bid their resources in a broad and complex range of markets is a premise for the efficient utilization of Norwegian hydropower resources and the ability to provide balancing flexibility to the system.

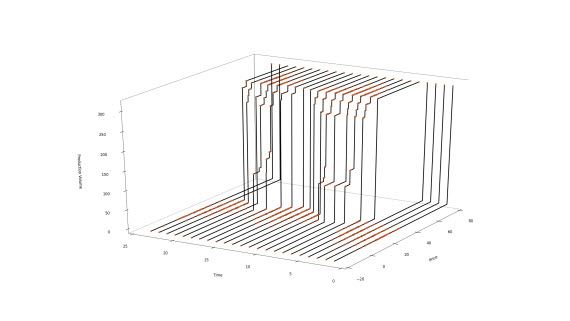

Bidding curves for Day-Ahead Market

Project scope

This project aims at learning how hydropower producers should bid in

day-ahead markets that are integrated in a sequence of balancing markets.

This will be achieved by studying optimal behaviour in short-term markets by the use of research models. The next step will be to extend the detailed hydropower scheduling models currently used by the industry with balancing markets based on the knowledge gained from the research models.

Providing a consistent description of market and inflow uncertainty is a

premise for both these steps.

We define the following major research tasks:

-

Modelling of uncertainty; how to model inflow and prices in the different short-term markets and their interdependence is crucial as this will be the input to the bidding models.

-

Multi-market modelling; there is a need to develop general knowledge about integrated markets, how to model their co-existence and how to obtain consistent and robust bidding strategies.

-

Hydropower bidding model; the modelling of balancing capabilities in the hydropower production system will be aligned with the balancing market extensions.