Consequences of the missing risk market problem for power system emissions

Challenge and objective

- Power system decarbonization could be hindered by incomplete long-term markets.

- Incomplete long-term markets may lead to sub-optimally little clean energy investment.

- Long-term market mechanisms for generation and storage could advance climate goals.

Work performed

- New approach to modeling risk-averse generation expansion with missing markets.

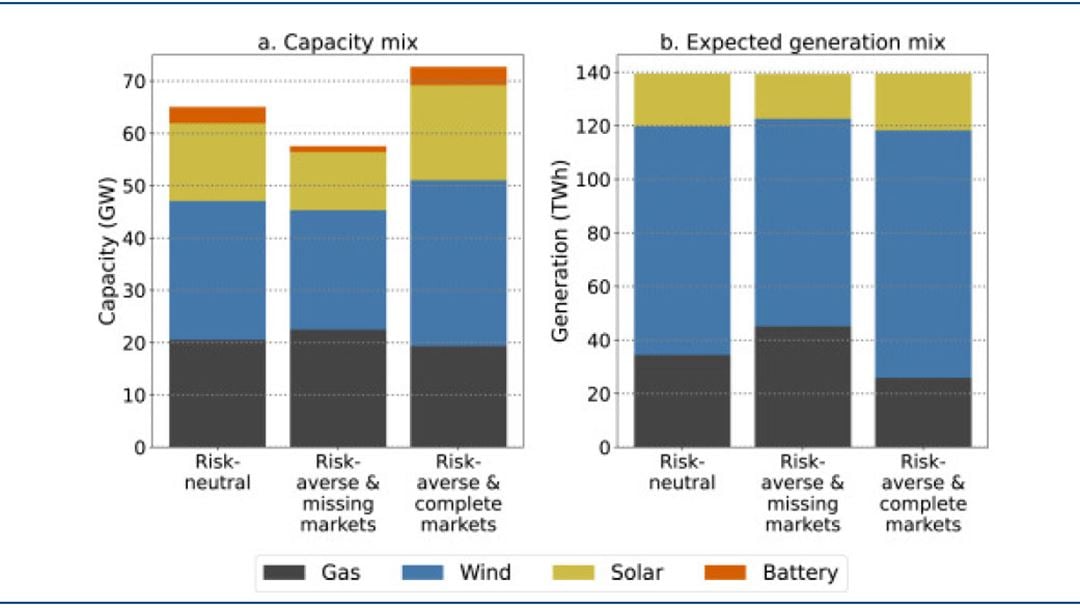

- Analysis of how the missing market problem impacts emissions, as well as how it impacts investments in variable renewables and storage.

Significant results

- We observe higher emissions and a shift in investment from renewables and storage toward fossil fuel plants when risk markets are missing.

- Absence of long-term markets may distort power system outcomes in a way that interferes with climate policy goals.

Impact for distribution system innovation

- Relevant for understanding how incomplete markets may be a barrier for PV, wind and grid batteries both in distribution grids and transmission grids.

- Name

- Magnus Korpås

- Title

- WP3 Lead

- Organization

Reference in CINELDI